According to the 2021, second annual PayFast e-commerce performance index, the increased online shopping trends we saw over the last two years are no longer a trend but a long-term consumer behaviour. From browsing and purchasing online, to contactless payments.

Based on PayFast’s data from September 2020 to August 2021, survey replies and first-hand interviews with e-commerce experts, South African consumers are set to stick to online shopping and not return to their old habits of trawling through brick-and-mortar malls and stores. According to PayFast, “Despite a difficult year, 48% of merchants saw an increase in revenue, spurred on by a 50% increase in online sales.”

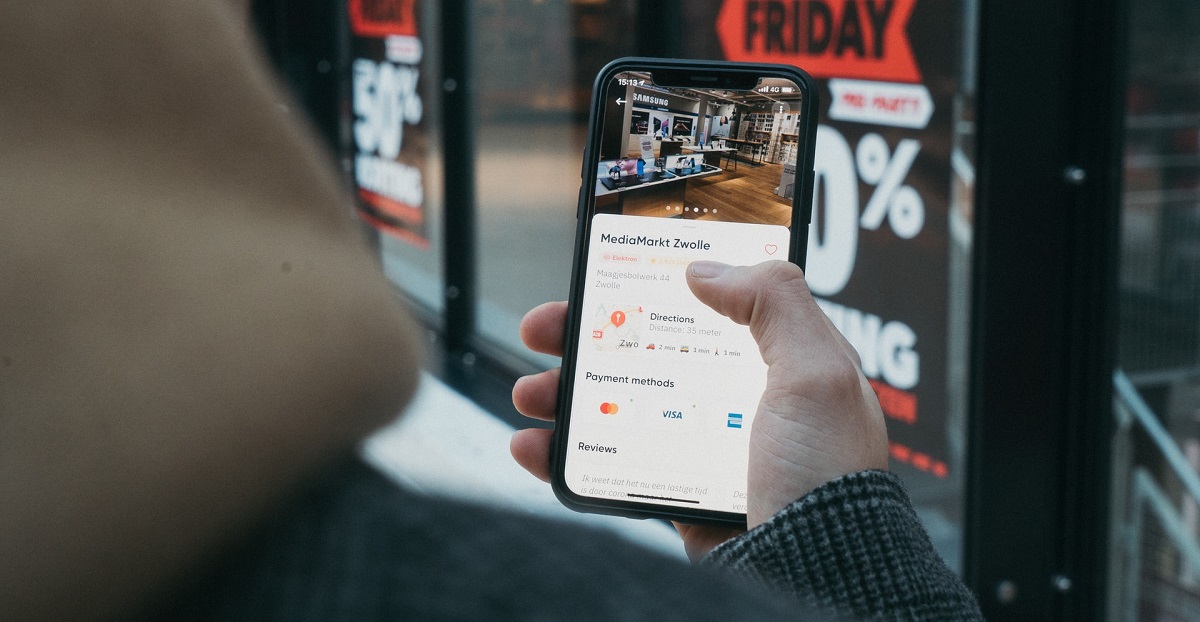

With this increase, the payment gateway revealed that 76% of all e-commerce businesses made sure their online stores were optimised for mobile, while 81% felt offering online payments was vital for business success. Plus with the likes of DIY web builders and web hosting so readily available, it’s easier than ever to get a business online for the first time.

Social commerce has also become much more recognised as a useful tool in business growth. Social media has fast become a selling tool, so much so that businesses can sell directly within various platforms. In fact 52% of businesses reported selling products directly via social media. Interestingly, those who didn’t invest in social commerce, aim to do so within a year. The top three platforms are Facebook, Instagram and TikTok respectively.

While restrictions have eased, vaccinations are increasing and life is slowly returning to “normal”, online payments have not dipped. In fact online shopping is only set to improve. “Looking forward, we expect to see total online retail sales of around R42-billion, increasing the share to 4% by the end of 2021, and R54-billion (5%) in 2022 – a positive post-pandemic outlook for local businesses”, says PayFast head of marketing, Colleen Harrison.

Despite the fact that many businesses in South Africa work in a cash-based economy, contactless payments are being embraced. Card payments are still the most popular at 63.7%, but instant EFT comes in second at 31.5% and QR payments third at 3.5%.

Browsing on mobile is king in South Africa, and the data shows that online shopping is no different. According to PayFast’s transactions over the last year, 64% of online shoppers used their mobile to complete purchases, while only 35% used their desktop, and only 1% used their tablet.

On top of all this data, businesses reveal they are positive about the future of commerce in the country. “With the vaccine rollout under way and a return to business-as-usual on the horizon, 76% of our merchants are feeling positive about the year ahead – versus 63% at the start of 2021. Considering the rate of growth, innovation and digital adoption across the country, the future of SA’s e-commerce industry is something local businesses can be very excited about.”

Key online shopping trends to keep in mind:

- Tuesday is the most popular day for online transactions

- Transactions peak between 9am and 1pm

- Fastest growing age online shoppers is 65+